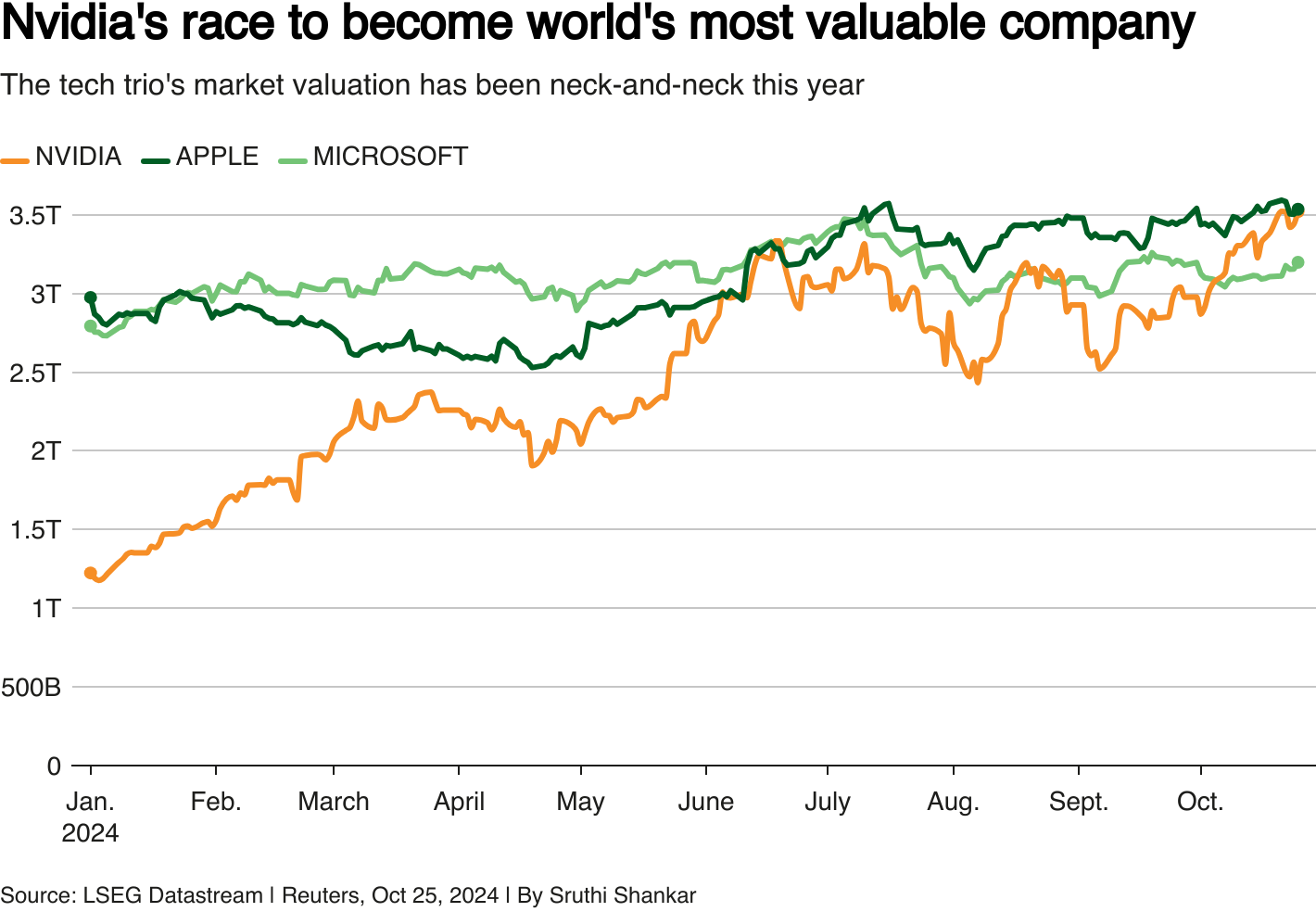

Nvidia briefly dethroned Apple as the world’s most valuable company on Friday, with its market value reaching $3.53 trillion before returning to $3.52 trillion. This leap was driven by robust demand for Nvidia’s advanced AI chips, which have fueled record stock performance.

Nvidia ended the day up 0.8%, with a market value of $3.47 trillion, while Apple’s shares rose 0.4%, valuing the iPhone maker at $3.52 trillion.

As the main supplier of processors for AI computing, Nvidia has surged ahead in a competitive landscape dominated by Microsoft, Alphabet, and Meta, all vying for a lead in AI. Nvidia’s position was bolstered this month by OpenAI’s new $6.6 billion funding round, along with strong quarterly profits reported by Western Digital, sparking optimism in the semiconductor sector.

Investment director Russ Mould of AJ Bell commented, “More companies are now embracing artificial intelligence in their everyday tasks, and demand remains strong for Nvidia chips.” Mould pointed out the favorable market outlook, noting that Nvidia “is certainly in a sweet spot, with a healthy tailwind for continued growth as companies keep investing heavily in AI capabilities.”

This rally in Nvidia’s stock follows impressive results from TSMC, the world’s largest contract chipmaker, which reported a 54% profit jump on Thursday due to the soaring AI chip demand. Nvidia’s AI processors have set it apart in a rapidly evolving tech landscape, placing the company as the biggest winner in the race to lead AI-driven innovation.

Meanwhile, Apple has been grappling with low demand for its smartphones. In the third quarter, iPhone sales in China fell by 0.3%, while rival Huawei saw a 42% jump in phone sales, pointing out Apple’s challenges in maintaining its lead.