Billboxx, a Nigerian fintech dedicated to solving invoicing and cash flow challenges for Small and Medium Enterprises (SMEs), has raised $1.6 million in a pre-seed funding round. The capital, a mix of debt and equity, came from investors including Norrsken Accelerator, Kaleo Ventures, 54 Collective, P2Vest, and Afrinovation Ventures.

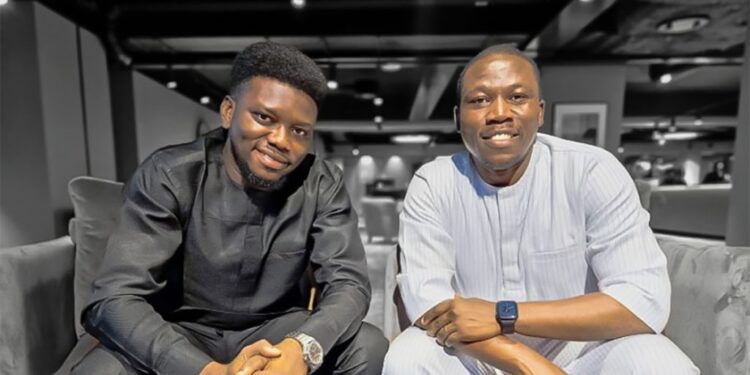

Founded in 2023 by Justus Obaoye and Abdulazeez Ogunjobi, Billboxx addresses a critical pain point for SMEs: long or delayed payment cycles from larger enterprise clients. The platform provides invoice financing, allowing SMEs to access advance payments while awaiting client approvals. With financing fees at 5% and transaction fees at 1.5%, Billboxx offers a cost-effective cash flow solution.

The startup claims to process ₦1 billion in monthly transactions with zero defaults. Highlighting the need for its services, co-founder Obaoye explained: “Every business we interacted with had billing inefficiencies and cash flow problems. Many still create invoices manually or with Excel sheets.“

Billboxx’s distribution model sets it apart, acquiring SME customers through partnerships with larger enterprises. The platform supports businesses like Monument Distillers and the International Institute of Tropical Agriculture (IITA). Unlike competitors targeting mid-market and enterprise clients, Billboxx focuses on solutions tailored specifically to SMEs.

The fintech also offers additional business banking services to help SMEs better manage their finances, strengthening its vision of becoming a “financial operating system for SMEs in Africa,” as Obaoye described.

Billboxx plans to expand across Africa and introduce new features aimed at connecting SMEs with market opportunities within corporate ecosystems. While details of this feature remain under wraps, the company’s trajectory indicates an ongoing commitment to empowering Africa’s underserved SMEs with innovative financial solutions.