Alphabet briefly touched a $4 trillion market valuation on Monday, as its sharpened focus on artificial intelligence eased doubts about its long-term strategy.

Investor confidence received a fresh boost after Alphabet confirmed that Apple’s next-generation AI models will run on Google’s Gemini technology under a multi-year agreement. The deal reinforced the company’s expanding role as a core AI infrastructure provider.

Alphabet’s Class A shares rose as much as 1.7% to a record high of $334.04 before paring gains later in the session. Still, the stock reaction shows growing optimism around its AI-led growth plan.

Last week, Alphabet overtook Apple in market capitalization for the first time since 2019, becoming the world’s second most valuable company. The shift highlighted how quickly sentiment has turned in Alphabet’s favor.

Among the so-called Magnificent Seven stocks, Alphabet has stood out over the past year. Analysts say the company is breaking away from its reliance on traditional advertising.

Phil Blancato, chief executive of Ladenburg Thalmann Asset Management, said Alphabet’s innovation has separated it from peers. He added that the company’s progress is increasingly visible in its earnings performance.

Momentum has also been driven by strong reception to Gemini 3. Reviews of the model have intensified pressure on OpenAI, particularly after GPT-5 failed to impress some users.

Alphabet’s cloud business has emerged as a key growth engine. Google Cloud revenue jumped 34% in the third quarter, while unrecognized contract backlog climbed to $155 billion.

Growth has been supported by Alphabet renting out its self-developed AI chips to external customers. Those chips were previously reserved for internal use. Rising demand for the hardware has attracted interest from rivals. The Information reported that Meta Platforms is in talks to spend billions on Alphabet’s chips for use in data centers from 2027.

Meanwhile, Alphabet’s advertising business has remained resilient. The unit has held steady despite economic uncertainty and stiff competition.

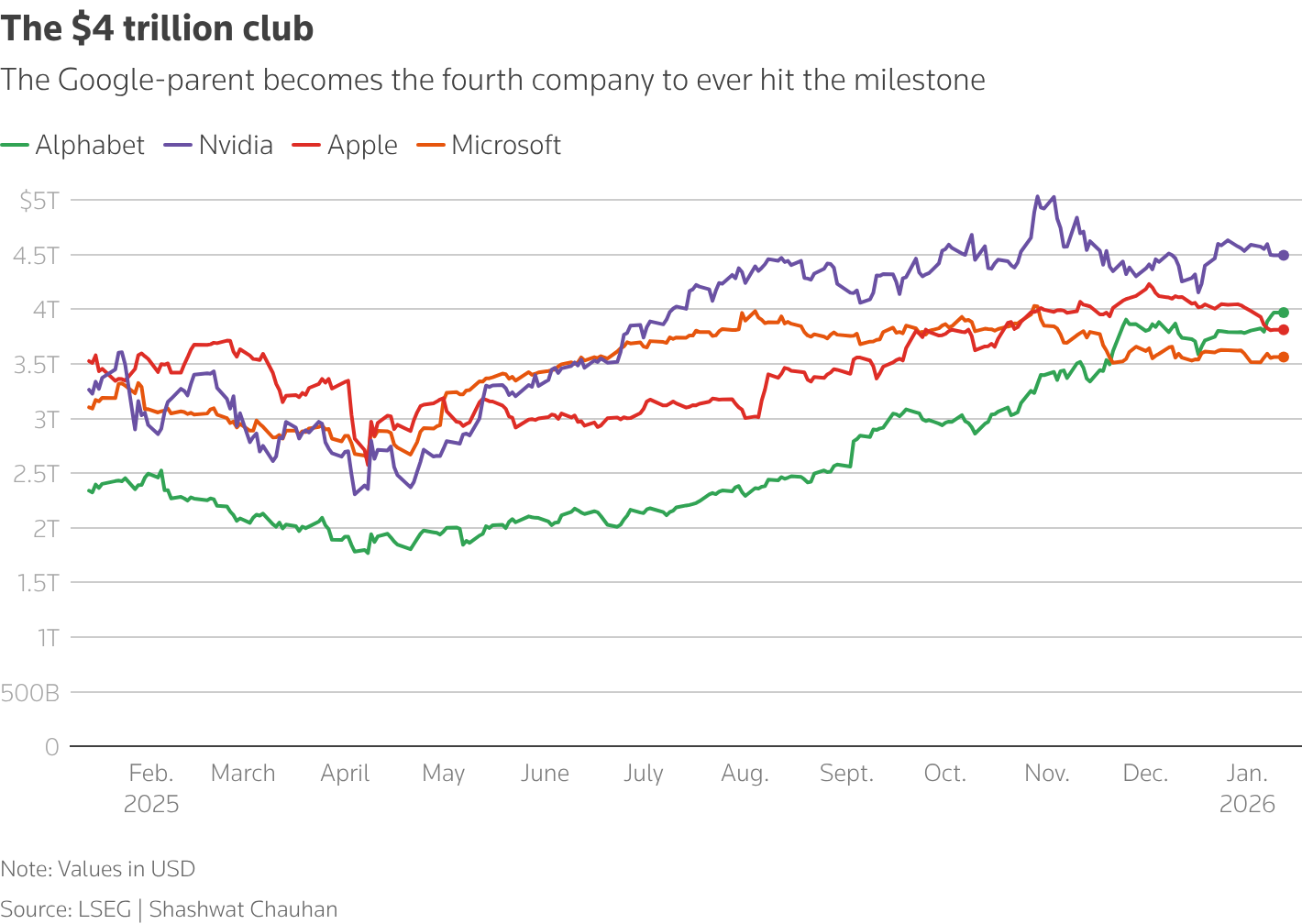

Alphabet is now the fourth company to reach the $4 trillion milestone, joining Nvidia, Microsoft, and Apple. The stock has also benefited from a U.S. court ruling last September that allowed the company to retain control of Chrome and Android.

Alphabet shares are up about 65% this year, outperforming most peers in Wall Street’s elite tech group.