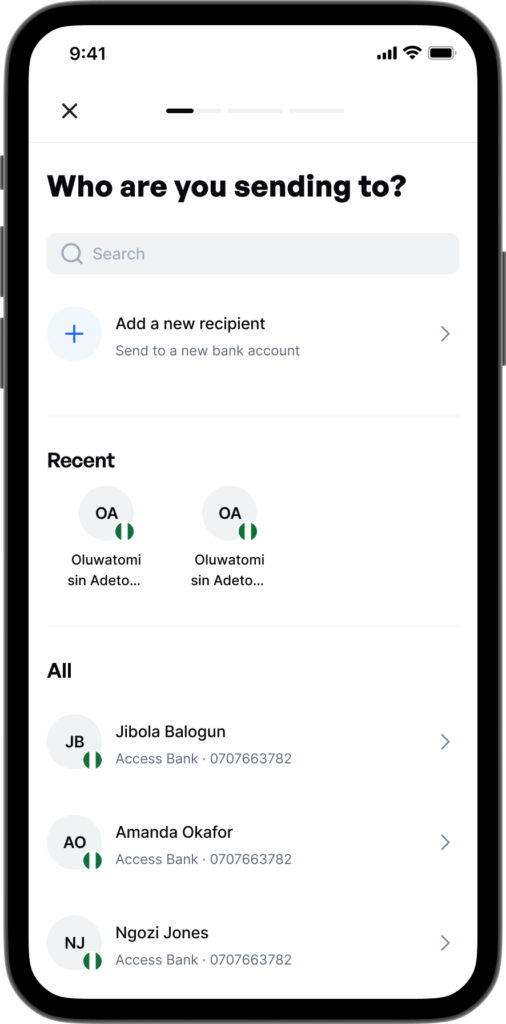

Moniepoint, the Nigerian fintech unicorn, has launched Monieworld, a new remittance service for UK residents. The app allows users to send money directly to any Nigerian bank account using a Monieworld account, cards, UK bank accounts, or even Apple Pay and Google Pay.

In a live demo seen by TechCabal, it took just 17 seconds to send £1 to a Nigerian account. Monieworld delivered ₦2,172—₦53 higher than Grey and ₦30 more than Lemfi.

For now, Monieworld only supports sending money to Nigeria. But that’s a massive market. Nigerians in the UK sent £2.7 billion home in 2021 alone.

Monieworld makes money through foreign exchange fees, but plans to expand its services soon. “Our goal is not just remittance but a full-fledged diaspora financial services platform,” said Moniepoint CEO Tosin Eniolorunda.

Moniepoint is best known for its blue POS machines across Nigeria. It has now expanded into personal and corporate banking. With Monieworld, it hopes to build a financial ecosystem serving Africans globally.

With $120 million from investors like Google and Visa, Moniepoint is using a familiar strategy: offer the best deal upfront. It currently offers the highest conversion rates, just like it once gave free POS terminals to agents.

That strategy worked. Today, Moniepoint processes over a billion transactions monthly, worth $22 billion.

“We are using pricing as a pull factor. We want people to try the product because it’s affordable and stay because it works,” Eniolorunda said.

Monieworld operates under Moniepoint’s IMTO license and a partnership with PayrNet in the UK. The company is also working to secure its own EMI license for even faster, fully-controlled transactions.

While competitors like Grey, Lemfi, and Wise exist, Moniepoint sees its real rival elsewhere. “Our biggest competitor in remittance is peer-to-peer transactions,” Eniolorunda explained.

With over 290,000 Nigerians living in the UK, Moniepoint is betting on its experience to convert them into digital users. “You can have great tech, but if you don’t know how to reach customers at scale, it won’t matter,” he said.

Expansion into other countries is coming, but only after Monieworld dominates the UK-Nigeria corridor.