Shares in Nvidia fell despite the AI chip giant announcing results of $30 billion in revenues for a three month period. Nvidia, which is the biggest winner so far in the AI rush, has seen its market capitalization reach over 3 trillion in March this year.

However, when the news was released, Nvidia’s stock went down by 6% in the hours following the announcement. On dropped another 2% in the morning session.

Analysts were able to come up with sales estimates of $28.7 billion. But, Nvidia was able to beat this estimate by far, and its sales growth was stunning 122% to last year’s same period.

Even with these tremendous figures, there have been fears that the pace at which the company grew could be coming to an end. Simon French, head of research at Panmure Liberum, remarked, “If you’re going to raise expectations that high, then you’ve got to keep growing at spectacular rates.”

The way the market has reacted indicates that some level of expectation management is being undertaken on the part of investors. Hargreaves Lansdown’s head analyst on equity, Matt Britzman, said, “It’s less about just beating estimates now. Markets expect them to be shattered, and it’s the scale of the beat today that looks to have disappointed a touch.”

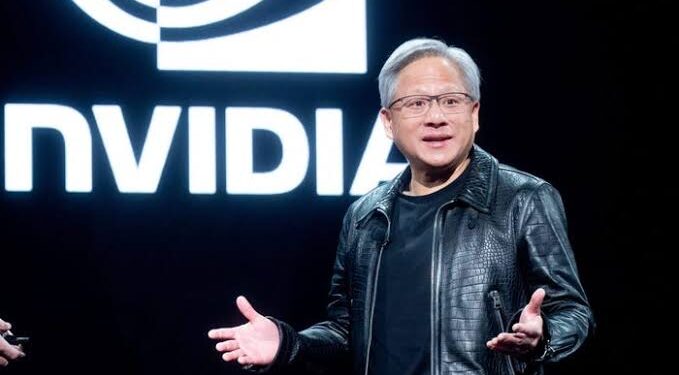

Nvidia’s CEO, Jensen Huang, remains optimistic about the future, stating, “Generative AI will revolutionise every industry.” However, French also pointed out that production delays for Nvidia’s next-generation Blackwell chip could be contributing to investor concerns.

Despite the recent dip, Nvidia’s stock is still up about 150% so far in 2024, solidifying its position as one of the biggest winners in the US market.