Ten of Nigeria’s biggest banks are reaping the rewards of the digital age. In 2024, they recorded a 58% jump in e-payment income, raking in ₦674 billion ($419.7 million) compared to ₦428.6 billion ($266.6 million) the year before.

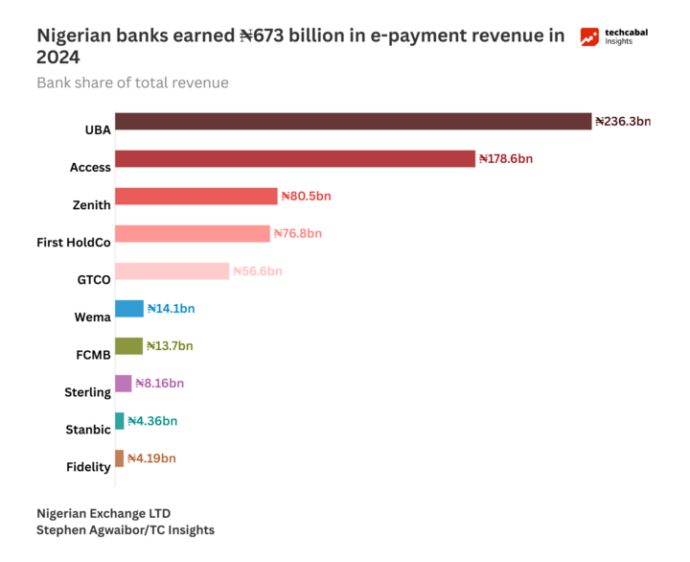

The surge stems from the growing use of mobile apps, cards, and other digital channels. Access Holdings, GTCO, UBA, Zenith Bank, First HoldCo, and others are riding this wave. Among them, UBA led the pack, generating ₦236.3 billion ($147.1 million) in e-banking revenue, closely followed by Access Bank with ₦178.6 billion ($110.9 million).

Transactions through the NIBSS Instant Payment platform soared to ₦1.07 quadrillion—nearly double the ₦600 trillion recorded in 2023. In the same breath, banks earned fees of ₦10 to ₦50 on transfers until December 1, 2024, when a new ₦50 charge for transfers above ₦10,000 kicked in.

Analysts say the trend is more than just a passing phase. “Revenue from e-banking is now proving to be a vital source of income for Nigerian banks,” said Israel Odubola, a Lagos-based analyst. “What was once a supplementary stream has become a strategic imperative.”

To keep up, banks have poured massive investments into tech. According to TechCabal, six major banks spent ₦268.7 billion ($171.5 million) on IT infrastructure in 2024 which is a 74.5% jump from the previous year.

More Nigerians are embracing cashless transactions, helped by mobile phones, internet access, and platforms like OPay and PalmPay. Meanwhile, the naira’s sharp devaluation since mid-2023 has fueled the rising value of transactions.

As Tajudeen Ibrahim of Chapel Hill Denham put it, “Any foreign currency bank settlement would have influenced that number.”

In just a decade, cash transactions in Nigeria fell by 59%, Worldpay reported. With ₦674 billion earned from ₦1.07 quadrillion in digital payments, Nigerian banks aren’t just adapting—they’re thriving in the new financial frontier.