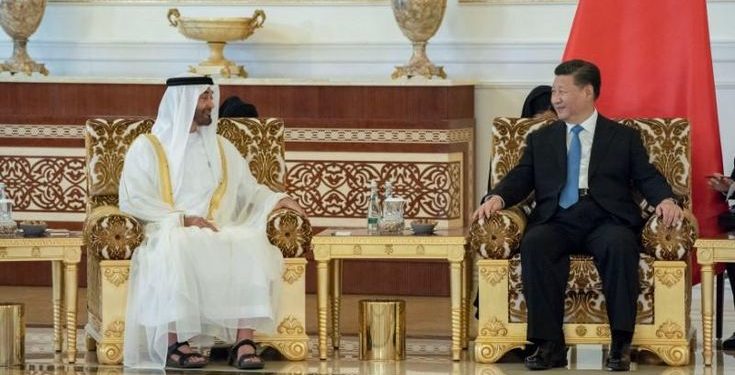

China and the United Arab Emirates (UAE) have entered into a landmark agreement to conduct liquefied natural gas (LNG) trade using the Chinese yuan. This move not only diminishes the dominance of the U.S. dollar in global energy transactions but also highlights the unintended consequences of U.S. tariff strategies.

The agreement, finalized in March 2023, involves the import of 65,000 tons of LNG from the UAE to China, settled in yuan. Facilitated by the Shanghai Petroleum and Natural Gas Exchange (SHPGX), this transaction marks the first of its kind between the two nations. According to Chinese officials, the deal promotes multi-currency pricing and strengthens cross-border payment systems in the international LNG market.

Further reinforcing the China-UAE energy alliance, Abu Dhabi National Oil Company (ADNOC) and China’s ENN Natural Gas have signed a 15-year deal for the supply of at least one million metric tonnes of LNG annually. Deliveries are expected to begin in 2028 from ADNOC’s Ruwais LNG project, which will be the first LNG facility in the Middle East and North Africa to operate using clean energy.

These developments come at a time when U.S. tariffs, particularly those imposed during the Trump administration, are facing growing scrutiny. Economic experts have warned that these tariffs are placing significant pressure on the U.S. economy. Recent projections suggest nearly a 50% chance of a U.S. recession in the near term. Tariffs have also contributed to rising inflation expectations and have limited the Federal Reserve’s ability to adjust interest rates effectively.

Torsten Sløk, chief economist at a major investment firm, has warned of a looming “Voluntary Trade Reset Recession,” attributing it to the burden of tariffs on small businesses a critical backbone of the U.S. economy. His analysis puts the risk of a recession as high as 90% due to the current trade climate.

The shift toward yuan-based energy transactions is part of a larger trend where nations are exploring alternatives to the U.S. dollar for global trade. As more countries diversify their financial systems and strengthen bilateral economic ties outside of U.S. influence, the effectiveness of American tariffs is increasingly being questioned.

This historic China-UAE gas deal is more than just an energy contract it is a signal of shifting power dynamics in global trade, finance, and diplomacy.