In Africa, the period since 2010 has witnessed the collapse of many startups due to funding challenges, internal struggles and market pressures including lack of liquidity and other deep-seated problems in firm formations.

Based on a report by DisruptAfrica that was released recently, venture capital funding for African startups reduced by almost 50% for the first half of 2023 as investors remained skeptical in view of rising interest rates and economic uncertainty.

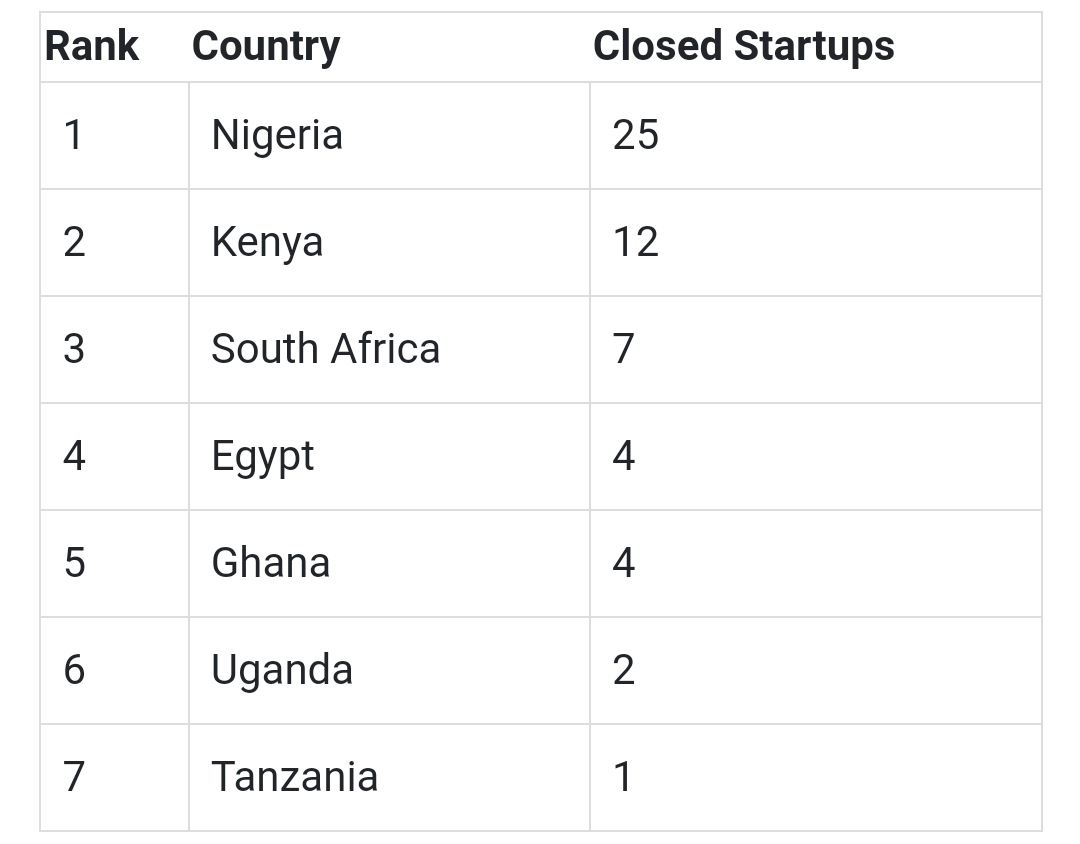

Many startups were left struggling with little or no funds hence leading to closure. Startupsgraveyard.africa reveals that 53 businesses have been closed across seven countries between 2013 and 2024.

Twenty-five start-ups have failed in Nigeria, which had the highest number of closures. They include Mocality found in Kenya as well as Nigeria and Ghana-based Pillow among others. These ventures covered sectors such as fintech, e-commerce, health care provision, logistics and agriculture sector.

According to experts, difficult in funding were not the only reason for these closures. However, many of the startups affected had received considerable investment in recent years but internal problems led them to their demise. These include Pivo, a Nigerian financial services platform that closed down due to conflict between its co-founders and Dash, a Ghanaian-based payment platform whose CEO had embezzled money.

Qefira, an e-commerce platform in Ethiopia also stopped its operations after the new ownership decided to shut down the firm.

As a result of these closures, there have been huge financial losses. In Nigeria alone, startup failures in 2024 led to investors losing $70 million as reported by Nairametrics.

Venture capitalists are calling for more demanding due diligence as African start-ups evolve seeking structures and leadership fit enough to survive in a tough market.