For years, cards have been a love-hate tool for Nigerian fintechs. While useful, they were expensive to maintain and unreliable. Many startups dumped them when bank transfers surged and foreign card costs soared. But one startup, Allawee, wants to flip the script.

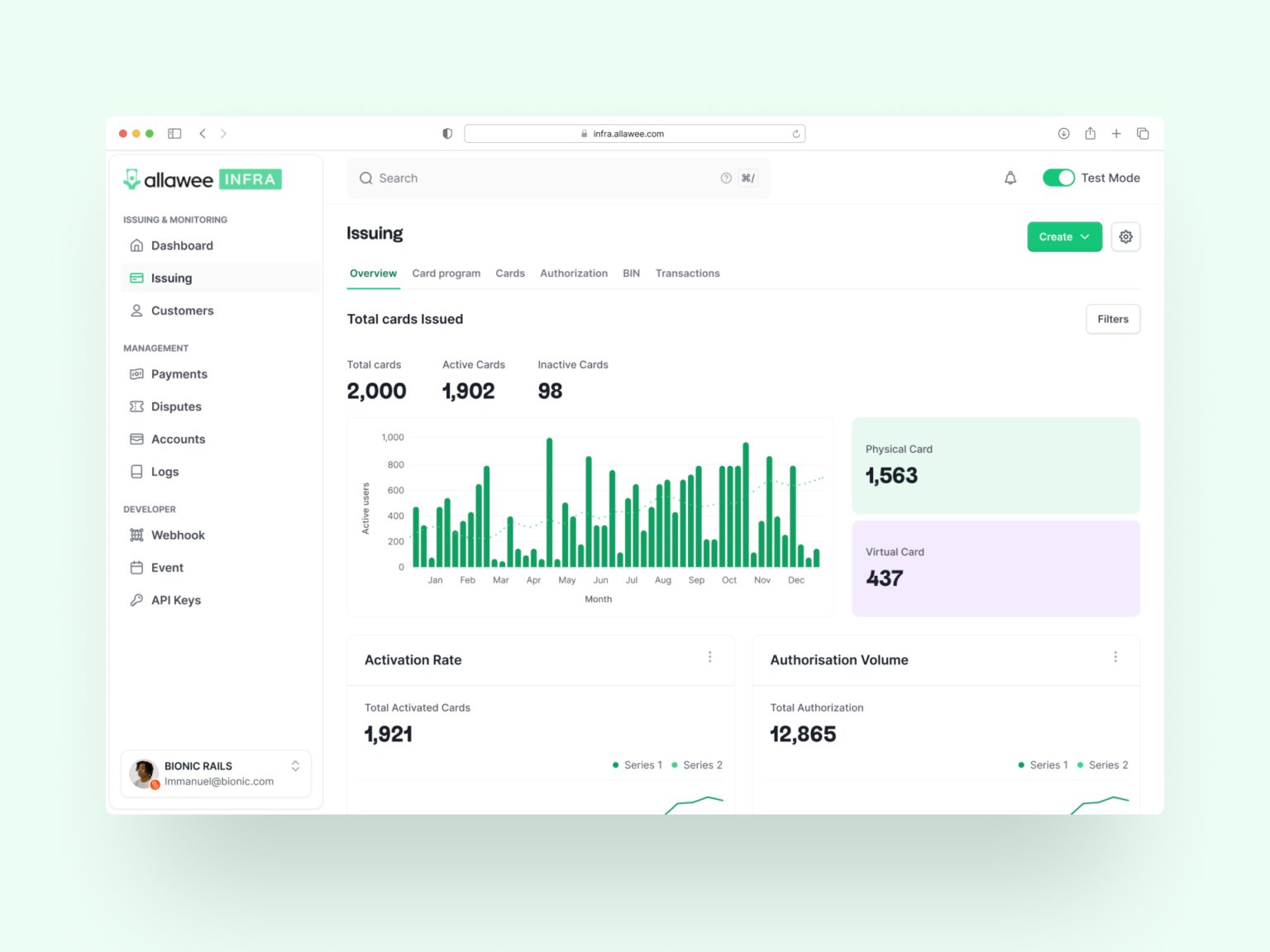

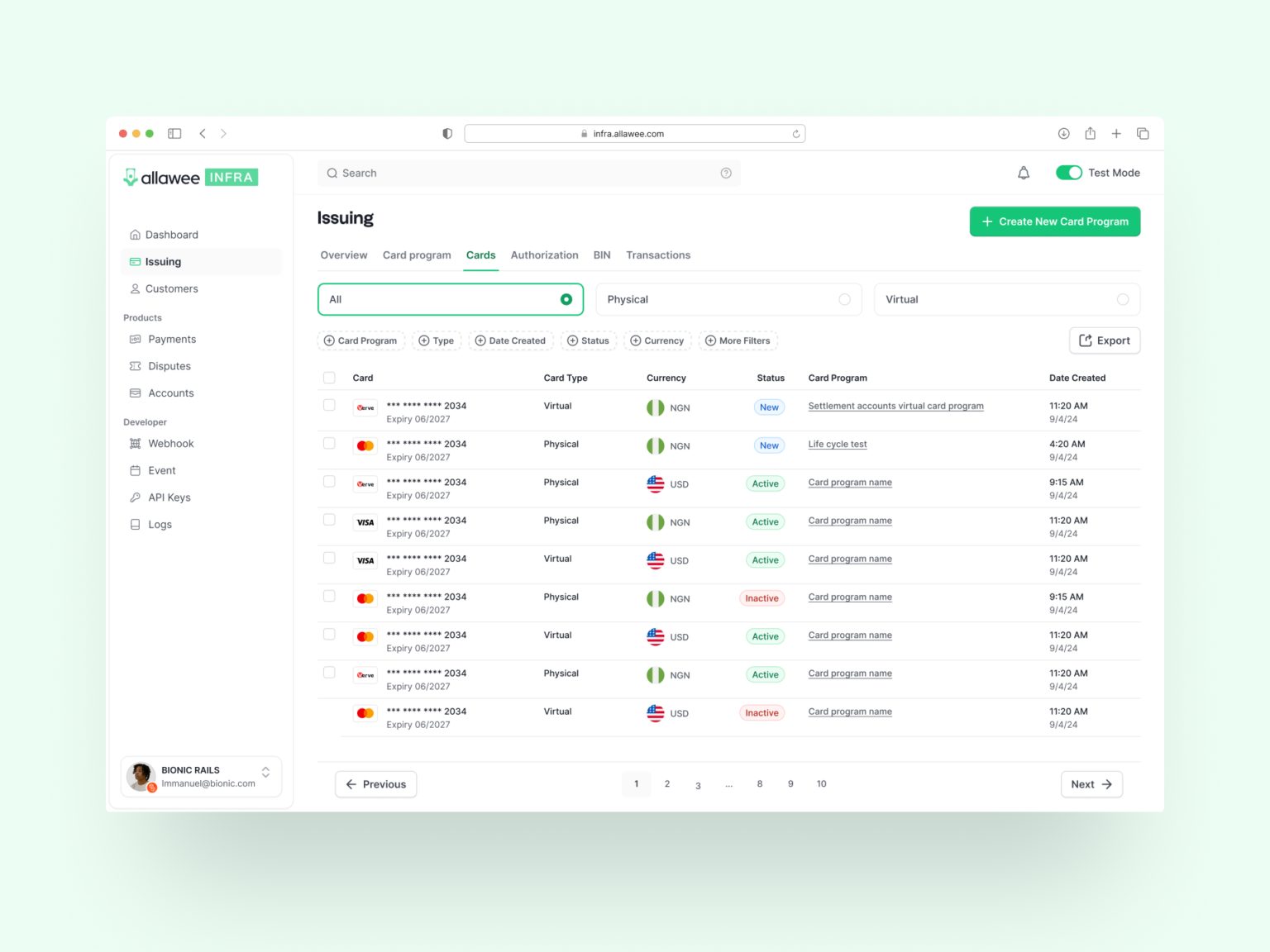

Allawee is helping fintechs like Piggyvest, Nomba, and Carbon issue their own cards through a simple, no-code or API-based platform. The company handles the complex stuff like core banking, card authorization, and integrations with Mastercard and Verve. This ensures that fintechs don’t have to.

“We’ve wrapped all of that into a simple tool,” said Ikenna Enenwali, Allawee’s CEO. That tool comes with a clear business model: monthly fees on active cards, a 0.5% cut of transactions, and premium charges for foreign payments.

Cards have fallen out of favor because they’re costly when idle. If users don’t swipe, fintechs still eat maintenance fees without earning revenue. With transfers now powering over half of Nigeria’s online payments, many fintechs decided cards weren’t worth the hassle.

But cards remain the easiest way for customers to access their money. Allawee’s bet is simple: make card programs fast, cheap, and reliable again.

Carbon is proof it can work. The 13-year-old fintech paused its card service in 2024, but demand pulled them back in early 2025. With Allawee’s help, they solved their biggest pain points: transaction failures and high fees. Cards now issue in weeks, not months.

“We rebuilt the commercial logic,” Enenwali explained. “A ₦5,000 ATM withdrawal shouldn’t cause a loss. With our setup, it doesn’t.”

Allawee also partnered with Mastercard to launch Naijacard, which charges in naira—even for foreign transactions. Verve integration cuts local fees to under ₦10 per use. The goal? Give fintechs a reason to believe in cards again.

The startup is now seeing 60% monthly transaction growth and plans to expand into Francophone West Africa by year’s end.

“The technology exists,” said Enenwali. “The problem was always poor integration and access. We fixed that.”

If Allawee keeps this pace, it might just bring cards back to the center of Nigeria’s digital payments ecosystem.