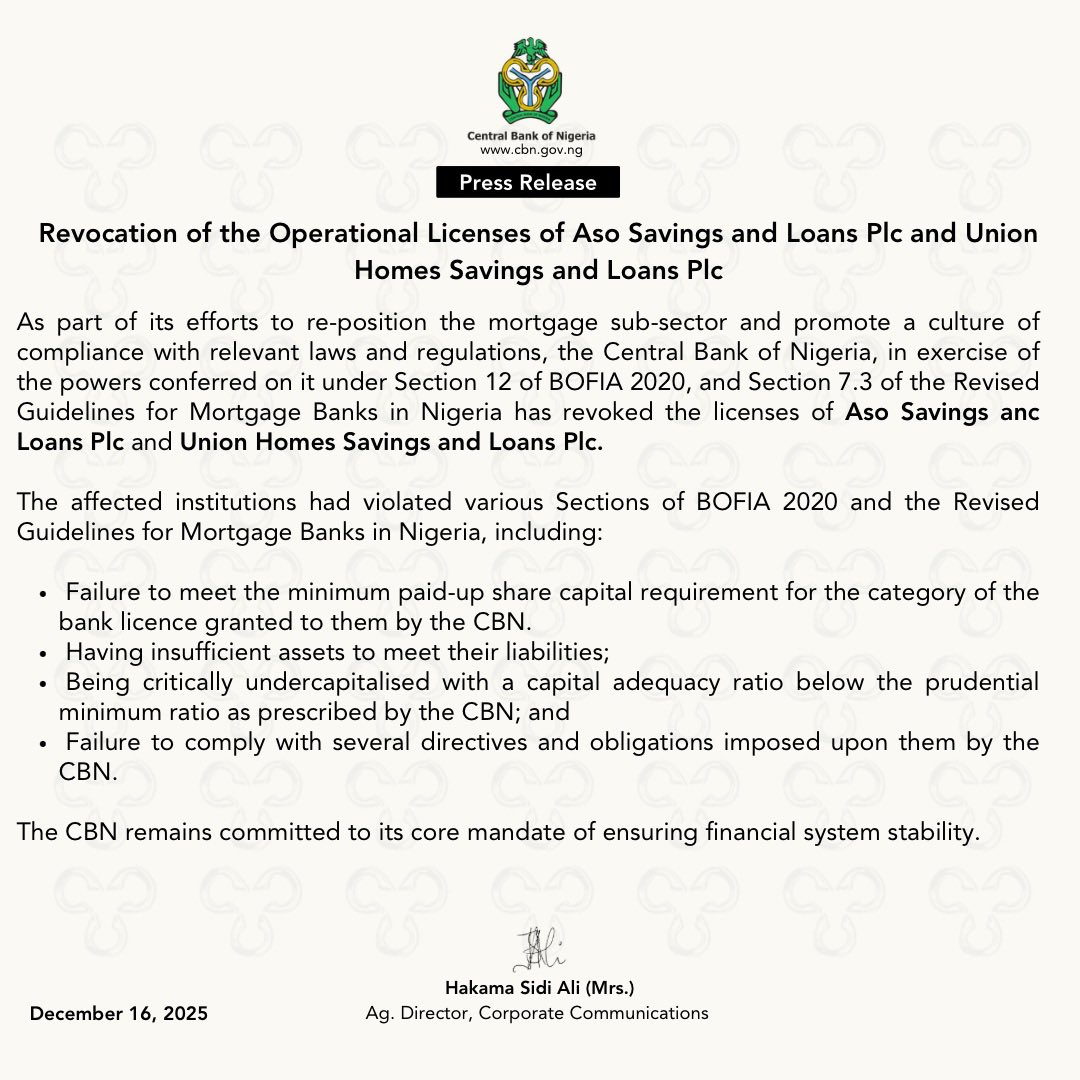

The Central Bank of Nigeria (CBN) has revoked the operating licences of two primary mortgage banks, Aso Savings and Loans Plc and Union Homes Savings and Loans Plc over regulatory breaches and financial distress.

The apex bank said the action was taken in line with its statutory powers under Section 12 of the Banks and Other Financial Institutions Act (BOFIA) 2020, as well as Section 7.3 of the Revised Guidelines for Primary Mortgage Banks in Nigeria.

According to the CBN, the affected institutions violated multiple provisions of BOFIA 2020 and the regulatory guidelines governing mortgage banks. These violations include failure to maintain the minimum capital adequacy ratio required for their licence category, persistent under capitalisation, and non-compliance with several directives and obligations issued by the regulator.

The CBN said the licence revocation forms part of broader efforts to restore stability in the financial system and promote a culture of sound corporate governance and regulatory compliance within the mortgage banking sub-sector.

It added that the decision was taken after the banks failed to address the identified weaknesses despite regulatory interventions.

The regulator reaffirmed its commitment to safeguarding depositors’ funds and ensuring a safe, sound and resilient financial system, warning that it would not hesitate to take similar actions against institutions that undermine financial stability.

The revocation takes immediate effect.