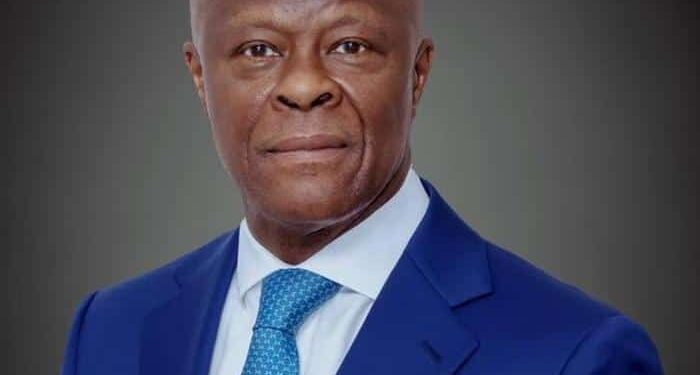

Nigeria’s Federal Government has reported a substantial increase in revenue for the first quarter of 2024, reaching N9.1 trillion. This figure marks a more than twofold increase compared to the same period in 2023. The announcement was made by Mr. Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, during the 17th Annual Banking and Finance Conference held by the Chartered Institute of Bankers of Nigeria (CIBN) in Abuja. Dr. Armstrong Takang, Managing Director of the Ministry of Finance, Incorporated, represented Edun at the event.

In his address, Takang emphasized that this remarkable revenue growth was achieved without raising taxes, attributing it to enhanced revenue collection strategies and technological advancements. The government is committed to continuing this positive trend to meet and potentially exceed its revenue targets, with the ultimate goal of facilitating significant social and capital investments.

Despite this progress, Takang highlighted ongoing concerns over rising food prices and inflation. The government is implementing various measures to address these issues and improve food supply.

Dr. Olayemi Cardoso, Governor of the Central Bank of Nigeria (CBN), expressed optimism about deriving practical solutions from the conference to support the bank’s goal of propelling the economy toward a $1 trillion milestone. Represented by Dr. Blaise Ijabor, Director of the CBN’s Risk Management Department, Cardoso underscored the pivotal role of the banking sector in Nigeria’s economic development.

Mr. Bello Hassan, Managing Director of the Nigeria Deposit Insurance Corporation (NDIC), commended the CIBN for hosting the conference and reiterated the NDIC’s commitment to enhancing confidence within the banking sector.

In his keynote address, Mr. Tony Elumelu, Chairman of the United Bank for Africa (UBA) Group, stressed the critical need for improved electricity access, security, and youth entrepreneurship as key drivers of Nigeria’s economic development. Elumelu linked food insecurity to broader security issues and lauded both current and past CBN governors for their transformative reforms in the banking sector.

CIBN President Prof. Pius Olanrewaju, in his welcome address, highlighted that the conference aimed to produce actionable outcomes. He noted a significant increase in net credit from the banking sector to the private sector, which rose to N74.9 trillion by July 2024 from N46.3 trillion in July 2023.