President Bola Ahmed Tinubu on Friday presented a ₦58.18 trillion 2026 Budget Proposal to a joint session of the National Assembly, outlining what the administration describes as a decisive transition budget—one aimed at closing legacy fiscal obligations, strengthening national resilience, and laying the foundation for shared prosperity.

Tagged “The Budget of Consolidated Renewal, Resilient Growth and Shared Prosperity,” the 2026 proposal marks a strategic turning point in Nigeria’s public finance management.

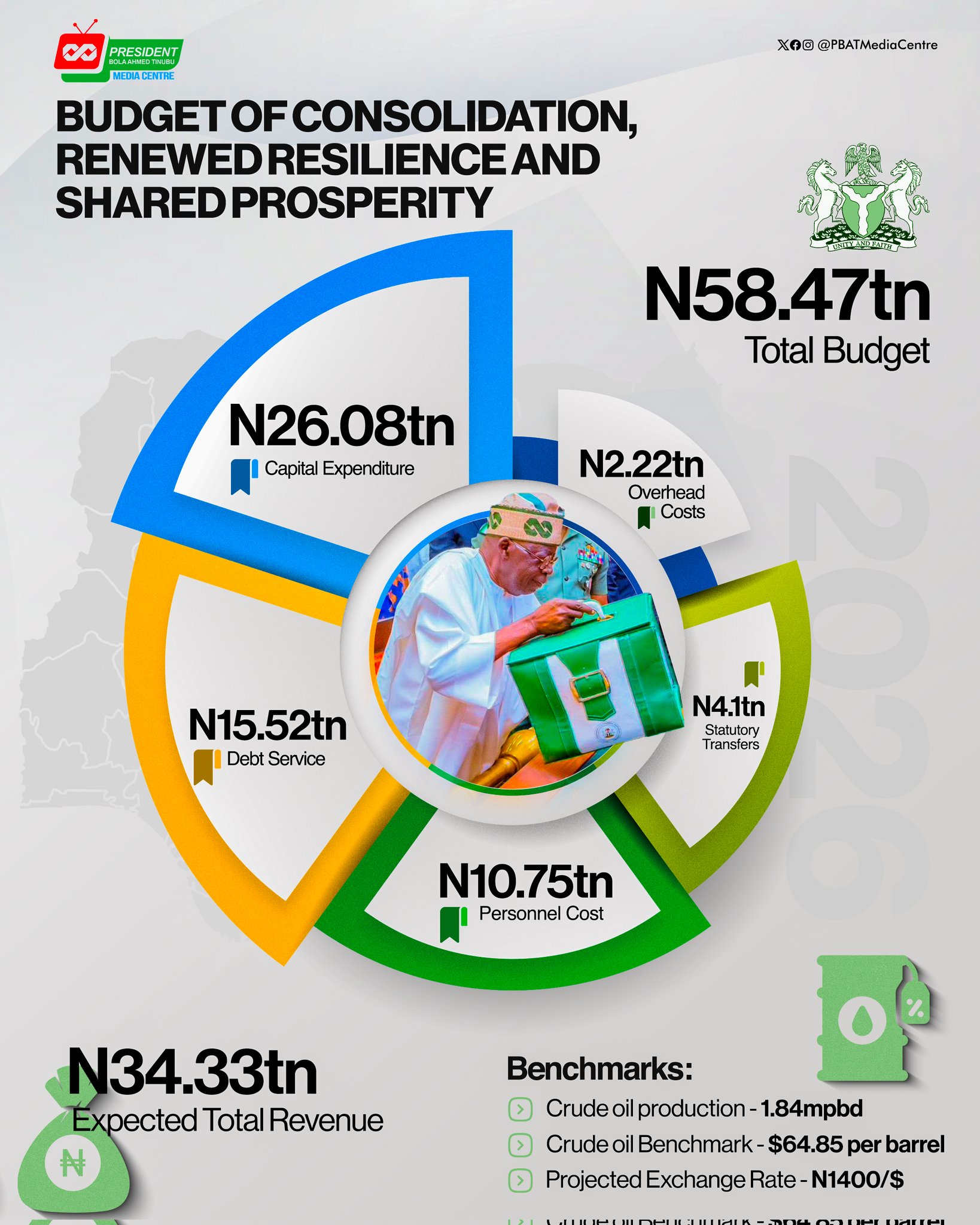

Key Budget Highlights

According to details released following the presentation:

- Total Budget Size: ₦58.18 trillion

- Capital Expenditure: ₦26.08 trillion

- Recurrent (Non-Debt) Expenditure: ₦15.25 trillion

- Debt Servicing: ₦15.52 trillion

- Expected Revenue: ₦34.33 trillion

- Budget Deficit: ₦23.85 trillion (4.28% of GDP)

The fiscal framework is anchored on:

- Crude oil benchmark: US$64.85 per barrel

- Oil production: 1.84 million barrels per day

- Exchange rate: ₦1,400 to the US dollar

Defence Emerges as Top Priority

In a clear reflection of prevailing security challenges, Defence received the single largest sectoral allocation of ₦5.41 trillion, reinforcing the government’s commitment to stabilising the country, safeguarding economic assets, and restoring investor confidence.

From a boardroom standpoint, the scale of defence spending also signals the administration’s recognition that economic reform cannot thrive without security stability.

Closing the Books on the Past

One of the most consequential policy declarations in the 2026 Budget is the plan to terminate the running three-budget cycle operated on a single inflow framework by March 2026. President Tinubu announced that all outstanding capital liabilities from previous fiscal years will be fully funded and closed within the same timeline.

This move effectively ends the rollover of unfunded capital obligations that has historically distorted budget credibility and strained public finances. By drawing a firm line under inherited and accumulated liabilities, the government aims to reset Nigeria’s fiscal balance sheet ahead of future budgets.

Consolidated Renewal and Fiscal Discipline

The administration positions the 2026 Budget as a consolidation exercise—less about expansionary promises and more about fiscal house-cleaning. Ending legacy capital liabilities is expected to free future budgets from arrears-driven constraints, improve cash-flow planning, and strengthen Nigeria’s standing with investors, lenders, and development partners.

The government maintains that while the deficit remains sizable, it is within a manageable threshold, and borrowing will be tied strictly to growth-enhancing and productivity-driven projects.

Boardroom Insight

From a market and policy perspective, the 2026 Budget sends three clear signals:

- Fiscal credibility over short-term populism

- Security as an economic enabler

- A deliberate transition from legacy burdens to forward planning

Execution remains the ultimate test. However, if the commitment to close all prior capital liabilities by March 2026 is honoured, Nigeria could enter the next budget cycle with a cleaner ledger and stronger fiscal resilience.

In essence, Budget 2026 is not merely another spending plan—it is an attempt to end an era of fiscal overlap and begin one of consolidated renewal.