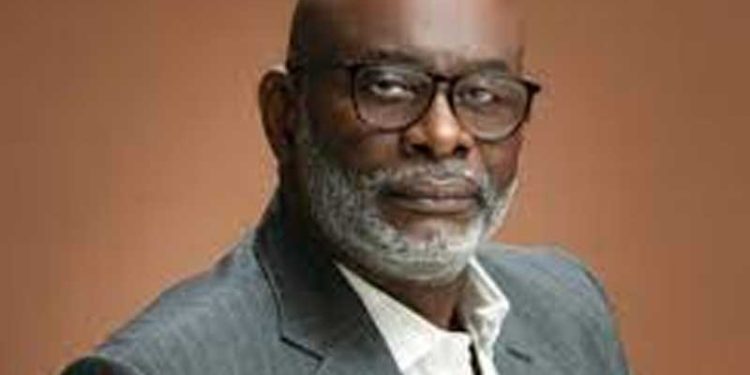

Chairman of the House of Representatives Ad-hoc Committee investigating fintech operations in Nigeria, Hon. Olufemi Bamisile, has accused the Central Bank of Nigeria (CBN) of having limited knowledge about the activities and locations of major fintech companies operating in the country.

Speaking during a live television interview, Bamisile said the committee’s ongoing probe uncovered “disturbing gaps” in the CBN’s supervision of digital financial institutions. He claimed that the apex bank could not provide clear information on where some fintechs operate or who their true owners are.

“It’s alarming that the CBN doesn’t even know where these operators are located,” Bamisile said. “We found out that OPay, for instance, is owned by someone in China. This raises serious national security and economic concerns.”

The lawmaker added that several major players in the sector, including Moniepoint, OPay, and Kuda Bank, ignored invitations to appear before the National Assembly. He said official emails sent to some of the companies bounced back, suggesting weak communication channels between regulators and operators.

Bamisile also hinted at possible collusion within the system, alleging that many fintech platforms operate through local agents while concealing ownership details. “There is an urgent need for transparency and accountability in the fintech space,” he said.

The committee was established to examine the operations of fintech companies and their compliance with Nigerian laws. The investigation is as a result of growing concerns over money laundering, fraud, and the rapid expansion of unregulated digital financial services.

Bamisile said the committee would complete its report within the set timeframe and make recommendations to strengthen CBN oversight, enhance data transparency, and protect users.