The Central Bank of Nigeria (CBN) has issued new agent banking regulations that will require all Point-of-Sale (POS) operators to work exclusively with one financial institution starting April 1, 2026.

The new rules, released on October 6, represent the most recent changes to agent banking since its introduction in 2013. The CBN said the policy aims to enhance oversight, improve service quality, and strengthen financial inclusion across Nigeria’s fast-growing POS network.

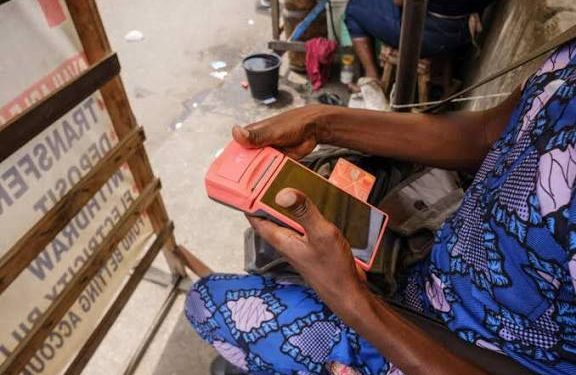

Under the new guidelines, banking agents also known as POS operators can no longer serve multiple principals, such as banks, microfinance institutions, mobile money operators, or super agents. Each agent must now be tied to one principal, which must publicly list all registered agents and their locations.

The rules also require agents to process all transactions through a dedicated account or wallet with their principal institution. Any operation outside that account will be treated as a regulatory breach and could result in termination or prosecution. Agents must maintain detailed transaction records and report suspicious activities to their principals, while the CBN now reserves the right to directly request records from agents.

The CBN said the reforms are designed to improve compliance with daily withdrawal limits of ₦1.2 million ($816) and location-based operating rules. The apex bank is also pushing stricter oversight as POS transactions hit ₦10.51 trillion ($7.15 billion) in the first quarter of 2025 — a 301% increase from a year earlier.

Nigeria currently has 8.36 million registered POS terminals, with 5.9 million active as of March 2025, according to industry data. The new rule could reshape the country’s agent banking ecosystem, where fintechs like Moniepoint, OPay, and PalmPay dominate.

“The guidelines ensure Nigeria’s agent banking remains stable, secure, and aligned with our broader monetary policy goals,” the CBN said.