Nigerian telecom provider Globacom has seen a major drop in market share after a large-scale subscriber review by the Nigerian Communications Commission (NCC).

The data shows Glo now has only 19.1 million active subscribers as of September 2024. That’s a massive drop from 62.1 million in March 2024. The drop is a result of the NCC’s decision to classify active subscribers more strictly, excluding lines without any form of revenue-generating activity for 90 days.

As part of the NCC’s guidelines, any SIM that doesn’t engage in activity—like calls, SMS, USSD, or data usage—is marked inactive if unused for 90 days. “Any qualifying activity within 90 days of activating a SIM makes it RG (revenue-generating),” said an NCC representative.

Additionally, subscribers are required to have a verified National Identification Number (NIN) to remain active.

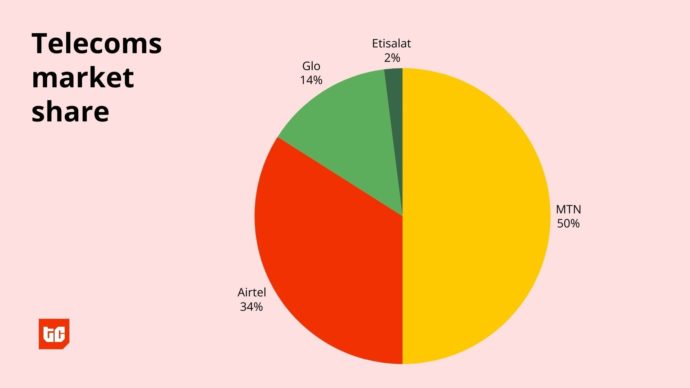

According to the NCC’s review, Nigeria’s total active subscribers dropped from 217 million in March to 154 million in September. Globacom was the hardest hit, losing around 40 million inactive subscribers. Other providers also saw declines: Airtel’s subscriber count dropped by about 9 million but held onto 53 million users, while 9mobile now has 3.6 million active subscribers after a similar cut.

MTN Nigeria, the market leader, was barely affected, with less than 3 million inactive users removed bringing its active subscriber base to 78 million. They now have a 50.5% market share, a massive jump from 38% earlier this year. Airtel also saw around 9 million inactive subscribers removed but retained 53 million users. Recently acquired 9mobile also experienced a substantial decline and now has 3.6 million active users.

Industry insiders suggest that some telcos may have inflated their subscriber counts, potentially violating NCC guidelines. “Directly violating the Commission’s guidelines for identifying active subscribers resulted in an inflated report of the operator’s subscriber count and skewed industry statistics,” an NCC source told TechCabal.

The NCC’s revised rules and active subscriber criteria have reshaped Nigeria’s telecom market, leaving MTN in a stronger position. This marks the start of a challenging period for Globacom and other providers.

Globacom did not immediately respond to a request for comments.