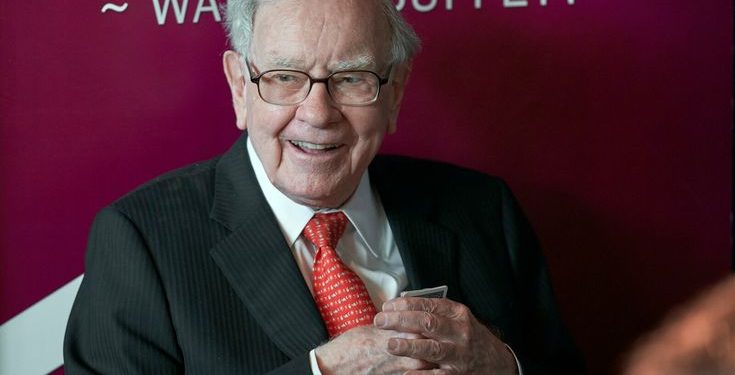

Few names in the world of finance evoke the kind of universal respect and admiration that Warren Edward Buffett does. Known as the “Oracle of Omaha,” Buffett is widely regarded as the greatest investor in modern history, a self-made billionaire who turned modest beginnings and classic value investing principles into a financial empire spanning decades and continents. His company, Berkshire Hathaway, has become a behemoth conglomerate with holdings in insurance, transportation, technology, energy, consumer goods, and finance.

In an age dominated by speculative bubbles, cryptocurrency hype, and meme stocks, Warren Buffett remains the standard for disciplined, long-term investing. This essay offers a deep dive into Buffett’s journey, investment philosophy, major holdings, and why he’s considered the greatest investor the world has ever seen.

Early Life: The Seeds of a Financial Genius

Warren Buffett was born on August 30, 1930, in Omaha, Nebraska, during the height of the Great Depression. His father, Howard Buffett, was a stockbroker and U.S. Congressman, and his mother, Leila, was a homemaker. Even as a child, Buffett displayed a fascination with numbers and money. He bought his first stock three shares of Cities Service Preferred at just 11 years old, a move that signaled the beginning of a lifelong obsession with investing.

By his teenage years, Buffett had already ventured into multiple small businesses selling chewing gum, Coca-Cola bottles, and delivering newspapers. At 15, he used his earnings to buy a pinball machine, placing it in a barbershop. He reinvested his profits into more machines and later sold the business. By high school graduation, Buffett had saved over $5,000, equivalent to more than $60,000 today.

The Education of an Investor

Buffett studied at the Wharton School of the University of Pennsylvania before transferring to the University of Nebraska, where he earned his undergraduate degree. He then attended Columbia Business School, where he studied under Benjamin Graham, the father of value investing and author of the seminal work The Intelligent Investor.

Graham’s investment philosophy focused on buying stocks trading below their intrinsic value became the cornerstone of Buffett’s own approach. He absorbed the principles of margin of safety, intrinsic value, and market irrationality, which would later form the foundation of his legendary investing career.

Buffett Partnership Ltd. and the Birth of a Legend

In 1956, Warren Buffett established Buffett Partnership Ltd., pooling funds from family and friends. He began with just $105,000 in capital, including only $100 of his own money. Over the next 13 years, Buffett averaged annual returns of over 29%, nearly triple the S&P 500’s average during that period.

Buffett’s strategy was simple but effective: invest in undervalued companies with strong fundamentals, avoid emotional decisions, and let compound interest do the heavy lifting. His disciplined approach and remarkable returns drew attention across the investing world.

The Berkshire Hathaway Transformation

Buffett’s most defining business move came in the early 1960s when he began acquiring shares of a struggling textile company called Berkshire Hathaway. Initially a “cigar butt” investment a cheap company with a final puff of value Buffett took control in 1965. However, the textile business floundered, and he later called it his “worst investment.” The real value came from using Berkshire as a holding company for more promising acquisitions.

One of his first smart moves was purchasing National Indemnity Company, an insurance firm. The company’s insurance float the money collected from premiums before claims are paid provided Buffett with low-cost capital to invest elsewhere. This became a core engine of Berkshire Hathaway’s long-term growth strategy.

Why Warren Buffett Is Called the Best Investor in the World

1. Unmatched Long-Term Performance

Between 1965 and 2024, Berkshire Hathaway’s stock delivered an average annual gain of 19.8%, compared to the S&P 500’s 10.2%. A $1,000 investment in Berkshire in 1965 would be worth over $30 million today. These numbers are unparalleled in the history of investing.

2. The Power of Compounding

Buffett is a master of compounding. He once said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” He believes time in the market beats timing the market. His habit of holding stocks for decades allowed value to accumulate exponentially.

3. Strict Investment Discipline

Buffett avoids trendy sectors and complex financial instruments. He invests only in companies he understands — what he calls his “circle of competence.” He avoids fads and speculative plays and instead focuses on businesses with durable competitive advantages or “economic moats.”

4. Legendary Holdings

Buffett’s portfolio includes some of the most iconic names in global business:

- Apple Inc.: Now Berkshire’s largest holding, Apple represents Buffett’s rare dive into tech, attracted by the company’s brand loyalty and cash flow.

- Coca-Cola: Purchased in the late 1980s, Buffett still owns over 400 million shares, and the dividends alone generate hundreds of millions annually.

- American Express: A long-term favorite, representing Buffett’s belief in brand power.

- Bank of America: One of Buffett’s largest financial holdings.

- Chevron and Occidental Petroleum: Reflecting his trust in stable, dividend-paying energy stocks.

- GEICO, See’s Candies, BNSF Railway: Wholly owned subsidiaries acquired through Berkshire.

5. Ethical Leadership and Shareholder Communication

Buffett is famous for his plainspoken shareholder letters, which outline his strategy, mistakes, and vision. Investors trust him because of his honesty and consistency. He promotes transparency, avoids short-termism, and emphasizes long-term shareholder value.

Notable Mistakes and Lessons Learned

Even the greatest investor has made mistakes. Buffett has been candid about his errors:

- Dexter Shoe Company: Acquired in 1993 with Berkshire stock, the company later collapsed. Buffett called it a billion-dollar blunder.

- Missing Big Tech: For years, he avoided tech stocks due to lack of understanding, missing early opportunities in companies like Google, Amazon, and Microsoft.

- Berkshire Hathaway’s Textile Business: His initial venture turned out to be a capital sink.

Yet, Buffett’s willingness to admit mistakes and learn from them is part of what makes him exceptional.

Philanthropy and the Giving Pledge

Buffett’s legacy isn’t just about money. He has pledged to give away over 99% of his wealth to philanthropic causes. He is one of the co-founders of the Giving Pledge, along with Bill and Melinda Gates, encouraging billionaires to donate at least half of their fortunes.

As of 2024, Buffett has donated more than $50 billion, primarily to the Bill & Melinda Gates Foundation and other charitable organizations. His actions reflect a deep belief in using wealth to improve society.

Succession Planning: Life After Buffett

At age 94, Buffett remains at the helm of Berkshire Hathaway, but succession plans are in place. Greg Abel, vice chairman of the non-insurance operations, has been named his successor. Abel is widely respected and has worked alongside Buffett for many years.

While the market has expressed concern about what Berkshire will look like without Buffett, many analysts believe the culture he built grounded in discipline, ethics, and long-term thinking will endure.

Timeless Investment Principles from Warren Buffett

- Buy businesses, not stocks.

- Be fearful when others are greedy, and greedy when others are fearful.

- Do not invest in businesses you don’t understand.

- Time is the friend of the wonderful business.

- Price is what you pay; value is what you get.

- The best investment you can make is in yourself.

These principles have guided Buffett through economic booms, busts, and crises and continue to shape investing wisdom today.

Conclusion: Buffett’s Legacy in the Investment World

Warren Buffett’s influence transcends the world of finance. He is not just the best investor of our time he is a symbol of rationality, patience, and principle-based leadership. His story proves that you don’t need complex strategies or insider information to succeed. You need discipline, time, and an unwavering commitment to value.

Through Berkshire Hathaway, Buffett has built an empire that touches nearly every part of the global economy. More importantly, he has created a framework for investing that will guide generations to come.

As we enter a new era with Buffett gradually stepping back his teachings remain a compass for those navigating the complexities of modern finance. In a world often driven by short-termism, Warren Buffett is a living reminder that long-term thinking, integrity, and simplicity still win.